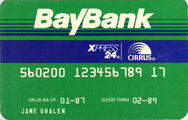

When I moved to Boston in 1988 for college, I was very excited to receive my first “BayBank card.” For those of you from the area, you’ll recall with a smile that BayBank was the dominant area bank; it subsequently merged with Bank Boston which then merged with Fleet. However, through all those changes everyone (at least in my circle) called their ATM card their “BayBank card.” Getting a BayBank card was really your only option if you valued the convenience of an ATM on each and every corner of the three mile stretch from Kenmore Square to Packard’s Corner in Allston. Back then I needed to get cash in $10 increments as easily as I could grab a slice at Captain Nemo’s Pizzeria on Comm Ave. or talk my way into Father’s First Bar in Allston.

When I moved to Boston in 1988 for college, I was very excited to receive my first “BayBank card.” For those of you from the area, you’ll recall with a smile that BayBank was the dominant area bank; it subsequently merged with Bank Boston which then merged with Fleet. However, through all those changes everyone (at least in my circle) called their ATM card their “BayBank card.” Getting a BayBank card was really your only option if you valued the convenience of an ATM on each and every corner of the three mile stretch from Kenmore Square to Packard’s Corner in Allston. Back then I needed to get cash in $10 increments as easily as I could grab a slice at Captain Nemo’s Pizzeria on Comm Ave. or talk my way into Father’s First Bar in Allston.

Over time, however, my needs as well as my definition of convenience changed. As time marched on, I started to think about buying a home, saving, and investing. Convenience was still the most important thing to me, but convenience now meant ubiquitous ATMs, a close branch to open new accounts, as well as a host of connected financial products. I liked being able to do all my business in one place. I was an established customer, and pretty pleased with the convenience of one-stop-shopping.

However, I feel like a new definition of convenience is on my horizon having more to do with useful, practical technology solutions. I want to view my investments, credit cards, savings accounts for my kids, and checking accounts all on one screen. I want to work with my bank virtually; I have two checks in my wallet, just sitting there waiting for me to make my way to an ATM machine. There is one up the street, about a half block diversion from my train, but without exception I leave work later than I should in order to collect my children from their babysitter, so I bypass that ATM. So there they sit, my sad paper checks, uncashed in my wallet and feeling very inconvenient.

The latest Consumer Pulse study from CMB uncovers some very interesting findings regarding convenience and perceptions of value among consumers. Nearly half (48%) of bank customers believe banks can differentiate themselves with good service. But they are like me—the definition of “good service” is evolving; convenience is no longer just about more branches and ATMs, but also about innovative technologies and remote banking options.

The study also found that while larger banks have a reputation for offering the most online and mobile services, credit union customers report online banking usage that is just as high as larger bank customers, and they give their institutions higher marks on performance than they’re larger peers. I would never have associated credit unions with convenience, but technology and their smaller customer bases are leveling the playing field. I wish that I had remote deposit capture, and I hear rumors that my big-bank provider has it, but I can’t find any information about it on my online banking portal. Not very convenient.

My brother-in-law is a 26 years old gadget-guy, and a rabid fan of USAA for both insurance and banking. He was never in the military (his grandfather was), so when I learned about his fandom, I was curious because it didn’t add up. I thought of USAA as traditional player, the epitome of an old-school company. He cited “great service” as the reason he’s loyal. When I asked what he meant by “great service,” he mentioned that he was first among his friends to have remote capture deposit. Definitions of service and convenience are changing; it will be fascinating to see which financial institutions keep up.

Learn more about how technology is changing the definition of good service:

![]()

Download the full report: The New Banking Value Proposition.

Posted by Christine Gimber, Christine is an Account Executive with CMB’s Financial Services team. A few of the things keeping Christine from cashing those checks are her three little kids, and competing in triathlons.

Last week CMB hosted

Last week CMB hosted