The next time you opt to skip the lines at the mall and do some online shopping from your couch, you may still have to show your face. . .sort of. MasterCard is experimenting with a new program that will require you to hold up your phone and snap a selfie to confirm a purchase. MasterCard will be piloting the new app with 500 customers who will pay for items simply by looking at their phones and blinking once to take a selfie. The blink is another feature that ensures security by preventing someone from simply showing the app a picture of your face in an attempt to make a purchase.

The next time you opt to skip the lines at the mall and do some online shopping from your couch, you may still have to show your face. . .sort of. MasterCard is experimenting with a new program that will require you to hold up your phone and snap a selfie to confirm a purchase. MasterCard will be piloting the new app with 500 customers who will pay for items simply by looking at their phones and blinking once to take a selfie. The blink is another feature that ensures security by preventing someone from simply showing the app a picture of your face in an attempt to make a purchase.

As we all know, passwords are easily forgotten or even stolen. So, MasterCard is capitalizing on technology like biometrics and fingerprints to help their customers be more secure and efficient. While security remains a top barrier to mobile wallet usage, concern about security is diminishing among non-users. In addition to snapping a selfie, the MasterCard app also gives users the option to use a fingerprint scan. Worried that your fingerprints and glamour shots will be spread across the web? MasterCard doesn't actually get a picture of your face or finger. All fingerprint scans create a code that stays on your phone, and the facial scan maps out your face, converts it to 0s and 1s, and securely transmits it to MasterCard.

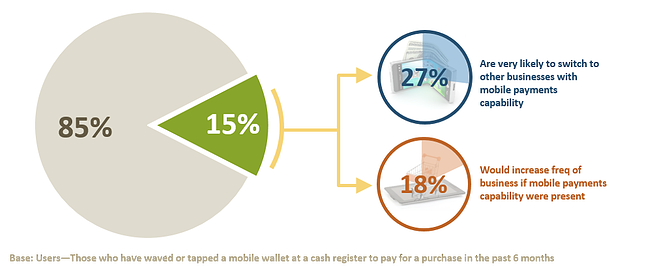

According to our recent Consumer Pulse Report, The Mobile Wallet – Today and Tomorrow, 2015 marks the year when mobile payments will take off. Familiarity and usage have doubled since 2013—15% have used a mobile wallet in the past 6 months and an additional 22% are likely to adopt in the coming 6 months. Familiarity and comfort with online payments has translated into high awareness and satisfaction for a number of providers, and MasterCard wants a slice of that pie. Among mobile wallet users, over a quarter would switch merchants based on mobile payment capabilities.

Clearly the mobile wallet revolution is well underway, but the winning providers are far from decided, and MasterCard is taking huge leaps to see how far they can take the technology available. If MasterCard can successfully test and rollout these new features and deliver a product that their customers are comfortable using, they can capture some of the mobile wallet share from other brands like Apple Pay and PayPal.

So what’s next? Ajay Bhalla, President of Enterprise Safety and Security at MasterCard, is also experimenting with voice recognition, so you would only need to speak to approve a purchase. And don’t forget about wearables! While still in the early stages of adoption, wearables have the potential to drive mobile wallet use—particularly at the point of sale—which is why MasterCard is working with a Canadian firm, Nymi, to develop technology that will approve transactions by recognizing your heartbeat.

Since technology is constantly adapting and evolving, the options for mobile payments are limitless. We've heard the drumbeat of the mobile wallet revolution for years, but will 2015 be the turning point? All signs point to yes.

Want to learn more about our recent Consumer Pulse Report, The Mobile Wallet – Today and Tomorrow? Watch our webinar!

Stephanie is CMB’s Senior Marketing Manager. She owns a selfie stick and isn’t afraid to use it. Follow her on Twitter: @SKBalls.

Over the last year I’d heard rumors of a new “super” Walgreens coming to Downtown Boston. To be honest, it sounded a little odd: a Walgreens with a sushi bar? A nail salon? But sure enough, one sunny day in May, a coworker announced the giant Walgreens had finally opened; of course I had to check it out. The moment I opened the doors I was like a kid on Christmas morning—this is not your mother’s Walgreens.

Over the last year I’d heard rumors of a new “super” Walgreens coming to Downtown Boston. To be honest, it sounded a little odd: a Walgreens with a sushi bar? A nail salon? But sure enough, one sunny day in May, a coworker announced the giant Walgreens had finally opened; of course I had to check it out. The moment I opened the doors I was like a kid on Christmas morning—this is not your mother’s Walgreens.

After a long weekend basking in the Nantucket sun, a few friends and I decided to take a break from the Cape Cod traffic and stop for some dinner at

After a long weekend basking in the Nantucket sun, a few friends and I decided to take a break from the Cape Cod traffic and stop for some dinner at