Who are the mobile consumers?

Let’s get this straight: I am not addicted to my smartphone. Unlike so many of my fellow train commuters who stare zombie-eyed into their small screens, I am not immersed in a personal relationship with pixels. I have an e-Reader for that. But, my smartphone IS my lifeline.I’ve come to depend exclusively on my phone to keep me on-time and on-schedule, to entertain me (when not using my e-Reader), to stay in touch with family and friends, and to keep up-to-date with my work email. It’s my primary source for directions, weather, news, photography, messaging, banking, and a regular source for payment, shopping, and ticketing/reservations. I haven’t purchased a PC in nearly a decade, and I don’t have a landline. I also use my smartphone to take market research questionnaires, and I am far from alone.

Let’s get this straight: I am not addicted to my smartphone. Unlike so many of my fellow train commuters who stare zombie-eyed into their small screens, I am not immersed in a personal relationship with pixels. I have an e-Reader for that. But, my smartphone IS my lifeline.I’ve come to depend exclusively on my phone to keep me on-time and on-schedule, to entertain me (when not using my e-Reader), to stay in touch with family and friends, and to keep up-to-date with my work email. It’s my primary source for directions, weather, news, photography, messaging, banking, and a regular source for payment, shopping, and ticketing/reservations. I haven’t purchased a PC in nearly a decade, and I don’t have a landline. I also use my smartphone to take market research questionnaires, and I am far from alone.

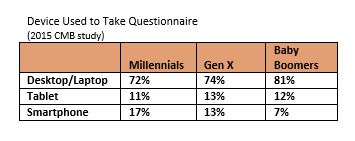

Data around smartphone usage aligns with my personal experience. In a recent CMB online study of U.S. consumers, optimized for mobile devices, 1 in 6 Millennials completed the questionnaire on a smartphone. Other studies report similar results. This example illustrates the issue with representativeness. Major panel vendors are seeing over half of Millennials joining their panels via a mobile device.

How do we adapt?

Much has been hypothesized about the future of market research under the new paradigm of mobile commerce, big data, and cloud services. New technologies and industry convergence (not just mobile) have brought sweeping changes in consumer behaviors, and market researchers must adapt.

A key component of successful adaptation will be greater integration of primary market research with other data streams. The promise of passive or observational data is captivating, but it is largely still in the formative stages. (For more on passive data, check out our recent webinar.) We still need and will likely always need active “please tell me” research. The shift from phone to online data collection has quickly been replaced with the urgency of a shift to mobile data collection (or at least device agnostic interviewing). Our industry has lagged behind because the consumer experience has become so personalized and the trust/value equation for tapping into their experiences is challenging. Tackling mobile market research with tactical solutions is a necessary step in this transition.

What should we do about it?

- Understand your current audience. Researchers need to determine how important mobile data collection is to the business decision and decide how to treat mobile respondents. You can have all respondents use a mobile device, have some use a mobile device, or have mobile device respondents excluded. There are criteria and considerations for each of these, and there are also considerations for the expected mix of feature phones, smartphones, tablets, and PCs. The audience will determine the source of sample and representation that must be factored into the study design. Ultimately, this has a huge impact on the validity and reliability of the data. Respondent invitations need to include any limitations for devices not suitable for a particular survey.

- Design for mobile. If mobile participation is important, researchers should use a mobile first questionnaire design. Mobile optimized or mobile friendly surveys typically need to be shorter in length, use concise language, avoid complex grids and answering mechanisms, and have fewer answer options, so they can be supported on a small screen and keep respondents focused on the activity. In some cases,questionnaire modularization or data stitching can be used to help adhere to mobile design standards.

- Test for mobile. All questions, images, etc. need to display on a variety of screen sizes and within the bandwidth capacity of the devices that are being used. Android and iOS device accommodation covers most users. If app based surveys are being used, researchers need to ensure that the latest versions can be downloaded and are bug-free.

- Apply data protection and privacy standards. Mobile market research comes with a unique set of conditions and challenges that impact how information is collected, protected, and secured. Research quality and ethical guidelines specific to mobile market research have been published by CASRO, ESOMAR, the MMRA (Mobile Marketing Research Association), and others.

- Implement Mobile Qualitative. The barriers are lower, and researchers can leverage the unique capabilities of mobile devices quite effectively with qualitative research. Most importantly, willing participants are mobile, which makes in-the-moment research possible. Mobile qualitative is also a great gateway to explore what’s possible for mobile quantitative studies. See my colleague Anne Hooper’s blog for more on the future of qualitative methodologies.

- Promote Research-on-Research. Experts need to conduct and publish additional research-on-research studies that advance understanding of how to treat mobile respondents and utilize passive data, location tracking, and other capabilities that mobile devices provide. We also need stronger evidence of what works and what doesn’t work in execution of multi-mode and mobile-only studies across different demographics, in B2B studies, and within different countries.

But perhaps the most important thing to remember is that this is just a start. Market researchers and other insight professionals must evolve from data providers to become integrated strategic partners—harnessing technology (not just mobile) to industry expertise to focus on decision-making, risk reduction, and growth.

Brian is a Senior Project Manager for Chadwick Martin Bailey, the photographer of the image in this post, and an 82 percenter—he is one of the 82% of mobile phone owners whose phone is with them always or most of the time.

Watch our recent webinar that discusses the results of our self-funded Consumer Pulse study on the future of the mobile wallet.

CMB’s portfolio is pretty expansive: we do research in a variety of industries and work with many different types of consumers—from insurance consumers to techies to medical experts to small business owners. We know how to get answers, and, more importantly, we are experts in getting to know our audiences. We learn more every day from our work, and we’re always willing to go above and beyond for our clients.I recently worked on a project with a kids’ media company that struck me as new, exciting, and something that I thought I would never come across unless I worked at a boutique kids-only research firm—I couldn’t wait to dive in! Our client wanted to understand kids today and segment the market beyond age and gender. The design, methodology, and project planning came naturally. However, when we reviewed the wording of the questionnaire, we knew we would have to step into our “kid” shoes and adjust accordingly.

CMB’s portfolio is pretty expansive: we do research in a variety of industries and work with many different types of consumers—from insurance consumers to techies to medical experts to small business owners. We know how to get answers, and, more importantly, we are experts in getting to know our audiences. We learn more every day from our work, and we’re always willing to go above and beyond for our clients.I recently worked on a project with a kids’ media company that struck me as new, exciting, and something that I thought I would never come across unless I worked at a boutique kids-only research firm—I couldn’t wait to dive in! Our client wanted to understand kids today and segment the market beyond age and gender. The design, methodology, and project planning came naturally. However, when we reviewed the wording of the questionnaire, we knew we would have to step into our “kid” shoes and adjust accordingly.

After nearly a decade working on highly complex and strategic research projects, I’ve learned the one thing you can count on when dealing with massive amounts of data is Murphy’s Law—anything that can go wrong, will go wrong. No matter how much planning we do (and we take planning very seriously), the nature of market research means there’s bound to be a hiccup or two along the way.One of the best ways to deal with Murphy's Law is to accept that issues will arise but to make sure they don’t get in the way of the end goal—actionable insights. At CMB, our ability to seamlessly execute projects hinges on our capacity to adjust and course correct (when needed) to keep things on track. We put a lot of preparation and time in putting together solid project plans, focusing on business decisions, and conducting stakeholder interviews, but we also place a lot of emphasis on hiring and training strong problem solvers. We do this because we know that even the best laid out plans can still go awry, which is why it's important to manage problems proactively. For example, CMB firmly believes in conducting stakeholder interviews at the beginning of nearly all research engagements. This allows us to proactively re-shape/re-think the questionnaire design based on the information we’re hearing from the stakeholders. This helps prevent getting to the final presentation and delivering insights that are not relevant or useable for the key stakeholders.

After nearly a decade working on highly complex and strategic research projects, I’ve learned the one thing you can count on when dealing with massive amounts of data is Murphy’s Law—anything that can go wrong, will go wrong. No matter how much planning we do (and we take planning very seriously), the nature of market research means there’s bound to be a hiccup or two along the way.One of the best ways to deal with Murphy's Law is to accept that issues will arise but to make sure they don’t get in the way of the end goal—actionable insights. At CMB, our ability to seamlessly execute projects hinges on our capacity to adjust and course correct (when needed) to keep things on track. We put a lot of preparation and time in putting together solid project plans, focusing on business decisions, and conducting stakeholder interviews, but we also place a lot of emphasis on hiring and training strong problem solvers. We do this because we know that even the best laid out plans can still go awry, which is why it's important to manage problems proactively. For example, CMB firmly believes in conducting stakeholder interviews at the beginning of nearly all research engagements. This allows us to proactively re-shape/re-think the questionnaire design based on the information we’re hearing from the stakeholders. This helps prevent getting to the final presentation and delivering insights that are not relevant or useable for the key stakeholders.

I once again had the pleasure of attending the

I once again had the pleasure of attending the