For those of you living in Siberia, I have a news flash: Boston had a nasty winter. Fortunately, spring has sprung, which has put an extra pep in my step for the past few weeks. That glorious feeling, coupled with an engagement I’ve been working on for Electronic Arts (EA), has inspired this blog. Martha Stewart says that “there are few rites of spring more satisfying than the annual clean.” Well, I’m no Martha Stewart (and for those of you who know me, the comparison is downright comical), but I do appreciate the general sentiment.

For those of you living in Siberia, I have a news flash: Boston had a nasty winter. Fortunately, spring has sprung, which has put an extra pep in my step for the past few weeks. That glorious feeling, coupled with an engagement I’ve been working on for Electronic Arts (EA), has inspired this blog. Martha Stewart says that “there are few rites of spring more satisfying than the annual clean.” Well, I’m no Martha Stewart (and for those of you who know me, the comparison is downright comical), but I do appreciate the general sentiment.

Martha’s extensive list of spring cleaning projects can be found here. But, instead of the proverbial laundry list, I’m going to focus on three of Martha’s tips that have implications in the world of insights, analytics, UXR, and consulting.

1. Organize files. Sure, there is also a tactical “file management” analogy here, but I’m talking about something more powerful and fundamental. I’m advocating that you step back and ask yourself whether you are appropriately allocating your resources to the right initiatives. Take a look back over the last year (or more) at all the work you have completed with a critical eye. Which projects have had true business impact? Which ones could have had impact, but weren’t adopted appropriately by your business partners? What types of work are you consistently conducting that either can’t or won’t have true business impact? Conversely, what could you be working on that would really move your business forward? When facilitated correctly, I bet that most of us would learn that we should shift at least some of our focus elsewhere.

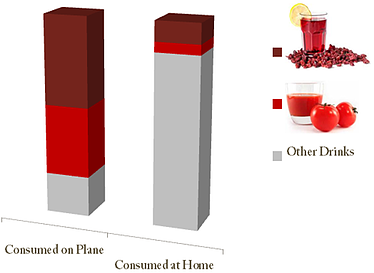

2. Swap out heavy curtains, throws, and rugs for lightweight ones. Not sure if you’ve noticed, but we live in a “Mobile First” world. A world where consumers have more choices and are harder to pin down and our business partners need fresh insights faster than ever just to keep up. This reality provides both challenges and opportunities when it comes to “old” methods of designing studies and collecting data. There’s still room for “heavy” (strategic/foundational) projects and amazing storytelling deliverables. However, we also need to make plenty of room for methods that provide insights quickly, utilize mobile data collection (with modules “stitched” together scientifically when longer questionnaires are required), and use workshops to get key results to business partners faster rather than waiting for a beautifully packaged final product. Innovative companies (many of whom will be attending the Insights and Strategies Conference in San Diego next week) continue to create exciting new tools. We’re excited to launch EMPACT℠: CMB’s Emotional Impact Analysis methodology next month—our solution to measuring the emotional payoffs consumers experience, want, and expect from a brand, product, or ad.

3. Ensure Fire Safety. Admittedly, this analogy is a bit of a leap, but I find that spending extra time to make sure that my family is in no danger from fire analogous to spending time with my team to ensure that we are all on the same page, working towards the same goals, and that I am providing the support I can to ensure their happiness, balance, and high performance. I was lucky enough to participate in EA’s Global Analytics and Insights Conference offsite last month, and these few days provided a great blueprint for doing this well. In a nutshell, Zack Anderson (EA’s VP of Marketing Science) leads a team of more than 60 Consumer Insights, Analytics, and UXR professionals. The 3-day agenda he developed included a mix of motivational speaking, priority setting, cross-team pollination, and good ole fashioned bonding activities. The theme of the conference was “Ideas. Relationships. Execution.”—and I think it delivered brilliantly on all three counts.

I suggest you all spend time pondering these three tips and finding the right way to execute them in your professional life. While none of them are as fun as playing a round of golf, I bet they’re all more fun than some of Martha’s other tips, such as resealing grout lines and dusting refrigerator coils.

Brant Cruz is our resident segmentation guru and the Vice President of CMB’s eCommerce and Digital Media Practice.

Want to learn more about EMPACT℠: CMB’s Emotional Impact Analysis? Watch our recent webinar as CMB's Brant Cruz and Dr. Erica Carranza share how we capture emotional payoffs to inform a range of business challenges, including marketing, customer experience, customer loyalty, and product development.

.png?width=348&height=232&name=brant_surfing_2_(2).png) Not too long ago, after hosting a gathering of some of the most talented, innovative researchers on the west coast (or really anywhere) I heard a story about another gathering of talented elites—

Not too long ago, after hosting a gathering of some of the most talented, innovative researchers on the west coast (or really anywhere) I heard a story about another gathering of talented elites—

I start to fantasize about Thanksgiving Day as soon as I’ve finished the last of the Halloween candy. From getting up at the crack of dawn, to saying grace, right up until the end of the fourth quarter of the last football game, Thanksgiving is filled with all kinds of wonderful rituals and traditions I look forward to every year. But things DO change –just as our forefathers never could have dreamt of the magnificent poultry innovation we call Turducken—few would have guessed how Black Friday’s evolved in just the last decade. Certainly the fact that many retailers will be starting their “Black Fridays” ON Thanksgiving has gotten no shortage of press. But it’s mobile’s impact on the shopping season that will likely decide the financial winners and losers.

I start to fantasize about Thanksgiving Day as soon as I’ve finished the last of the Halloween candy. From getting up at the crack of dawn, to saying grace, right up until the end of the fourth quarter of the last football game, Thanksgiving is filled with all kinds of wonderful rituals and traditions I look forward to every year. But things DO change –just as our forefathers never could have dreamt of the magnificent poultry innovation we call Turducken—few would have guessed how Black Friday’s evolved in just the last decade. Certainly the fact that many retailers will be starting their “Black Fridays” ON Thanksgiving has gotten no shortage of press. But it’s mobile’s impact on the shopping season that will likely decide the financial winners and losers.