The next time you attend a market research conference, listen very, very carefully. That dull buzzing sound you hear is the collective whine of hundreds of market researchers lamenting their inability to get a seat at the big kids' table or even just some recognition for all the value they provide.

I know it hurts, but it’s time to do some soul searching and address the all too common ways market researchers get in their own way:

-

over-reliance on statistical significance

-

inability to put oneself in the business partner’s shoes

-

focusing on research objectives rather than business objectives

-

unwillingness to commit to a point-of-view regarding what the data means

I’m not the only one who’s picked up on these industry-wide weaknesses; witness the popularity of the mysterious Angry MR Client on Twitter and GreenBook. There isn’t a silver bullet that will fix all of the issues facing our industry, but I am sure of this: we need to communicate better.

Over and over I hear people lament that researchers need to do a better job “telling stories.” I agree completely, and it’s something we have prided ourselves on at CMB for the last 5-10 years. Lucky for us, while there’s always been and always will be a “story” to tell, there are now so many more tools to help us elicit that actionable insight from the stream of data. Say what you will about the rise of the quants but there’s much to be said about the art of data, and that can mean taking a visual approach to data—no, not a pie chart.

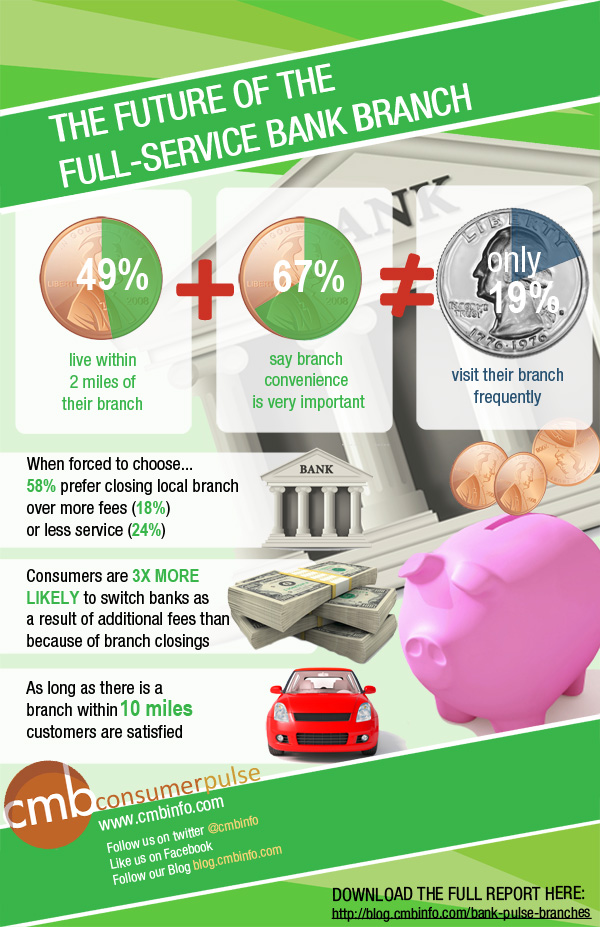

At CMB, we have graphic designers who, in addition to making our PowerPoint reports look great, have also designed some great infographics. There are so many more mediums for storytelling available to us and it would be crazy not to take advantage of them. Maybe there’ll always be an audience for the traditional PPT report/presentation, but I’ll bet there’s also an audience for an infographic, like the one below, highlighting key takeaways:

We’ve provided these for Customer Experience and Brand Tracking engagements and our clients really enjoy them. Easy to read visuals, like infographics, are a great way to socialize key takeaways across an organization where not everyone needs to go through a huge deck.

We’ve also gotten great feedback on our Prezis – mini movies that add energy and emotion to the story. Check out this one that we’ve dummied up to tell the story of a fictitious bank.

ABC Bank Video from CMBinfo on Vimeo.

We’ve given these in advance of an annual presentation and the result has been increased attendance, improved engagement, and better solution-brainstorming.

These are just two really simple examples of how you can take storytelling to the next level, engage your audience in the insight, and perhaps get that seat in the C-Suite.

Jim is Managing Director of CMB’s Financial Services practice. He enjoys sweeping historical dramas and is working on his Downton Abbey infographic.

Stephanie Kimball, our Marketing Operations Manager, created the infographic and Prezi you see here. She gets her inspiration from many places, including the 3 million Redbox movies she rents every week.

When I moved to Boston in 1988 for college, I was very excited to receive my first “BayBank card.” For those of you from the area, you’ll recall with a smile that BayBank was the dominant area bank; it subsequently merged with Bank Boston which then merged with Fleet. However, through all those changes everyone (at least in my circle) called their ATM card their “BayBank card.” Getting a BayBank card was really your only option if you valued the convenience of an ATM on each and every corner of the three mile stretch from Kenmore Square to Packard’s Corner in Allston. Back then I needed to get cash in $10 increments as easily as I could grab a slice at Captain Nemo’s Pizzeria on Comm Ave. or talk my way into Father’s First Bar in Allston.

When I moved to Boston in 1988 for college, I was very excited to receive my first “BayBank card.” For those of you from the area, you’ll recall with a smile that BayBank was the dominant area bank; it subsequently merged with Bank Boston which then merged with Fleet. However, through all those changes everyone (at least in my circle) called their ATM card their “BayBank card.” Getting a BayBank card was really your only option if you valued the convenience of an ATM on each and every corner of the three mile stretch from Kenmore Square to Packard’s Corner in Allston. Back then I needed to get cash in $10 increments as easily as I could grab a slice at Captain Nemo’s Pizzeria on Comm Ave. or talk my way into Father’s First Bar in Allston.