You’re about to step out your front door...

You’re about to step out your front door...

But wait just a moment! You can only take your phone or your wallet, which will it be?

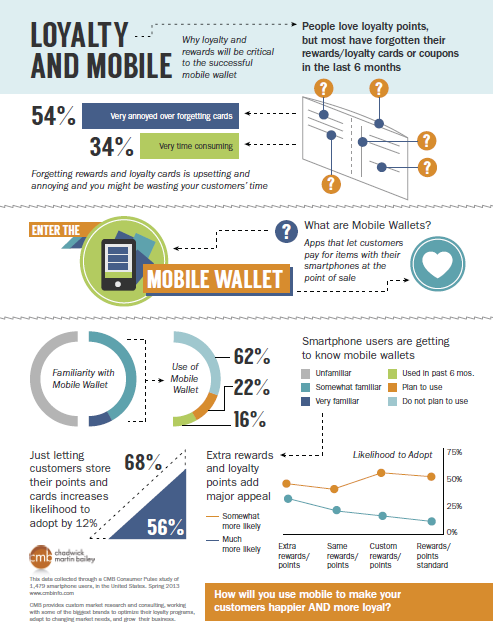

Pre-smartphone there would be no contest, I’d take my wallet. But times have changed, and the balance has now tipped in favor of my beloved iPhone. Beyond checking email, I use my phone to deposit checks, see when the train is coming, read the news, record my ski stats, listen to music, and if I've also forgotten my lunch, I can use a mobile wallet app to buy a sandwich at the deli across the street.Of course there’s more to mobile wallets than the fate of my lunch, there are billions of dollars at stake for the banks, credit card companies, start-ups, tech giants and others who want to dominate, or just cash in on, the evolving relationship we have with our smartphones. In our latest Consumer Pulse, we surveyed 1,479 smartphone users about what they know about mobile wallets, what’s keeping them from using, what features they’d like to see, and who they'd trust to provide them.

First things first, half of respondents said they were familiar with mobile wallet technology (or proximity payments)—apps that let users swipe or tap their phone at the point of sale, rather than using credit cards or cash. When we asked this 50% to tell us about their experience and expectations for using mobile wallets most said they didn’t plan on adopting a mobile wallet…but nearly a quarter said they were planning to try out the technology in the next 6 months (TWEET THIS). That’s no small number considering smartphone ownership is nearly ubiquitous.

Now let’s consider our more reticent smartphone users, what’s keeping them from trying out the technology that’s already at their finger-tips? We weren’t surprised to find that security (73% called it a barrier to adoption)—particularly identity theft—was high on the list of what’s keeping people from giving up on cash and credit (TWEET THIS). The good news for mobile wallet providers is 79% said they’d be more likely to adopt if they were guaranteed 100% protection against fraud and theft. While many mobile wallet providers already offer this protection, the results show there’s a real opportunity to benefit from promoting this type of security measure (TWEET THIS).

If you’ve assuaged the fear of being scammed, stolen from, and over-charged (remember when people were afraid to shop online?) what’s next? Aside from the novelty of scanning your phone, what’s the incentive behind using a mobile wallet over your, just as convenient, credit card? We found reward and loyalty points were very appealing, particularly when offered as additions to existing rewards people get with their credit cards—80% of non-adopters said they’d be more likely to adopt if offered these extra rewards (TWEET THIS). Of course people like rewards and points—you don’t need to be a marketer to understand that. But nearly as many (66%) said that getting the same rewards they got with their credit card would increase their likelihood to adopt—to which I say, c’mon people aim a little higher.

So yes, rewards are nice, but one of the best things about smartphones is the ability to look stuff up. Think of how many arguments have been nipped in the bud by a quick search of imdb.com or Wikipedia. That ability to find the information you want any time, any place, is just as compelling in a shopping context. Including location-based services like the ability to easily compare items in stores nearby increases likelihood to adopt among 78% of non-adopters (TWEET THIS). But we also found people were a little leery of getting too many alerts, both because they can be annoying and because they suck down battery life. Note to providers, offering people the choice of what alerts and discounts they receive could be a major draw as they decide who they’d like to provide their mobile wallet service.

The topic of mobile is rightly dominating the discussion in almost every industry, but the fact is, for most people mobile wallets are still incredibly new. Amid all the noise and growth, there’s still tremendous opportunity for providers who understand the concerns, goals, needs, and desires of the millions (billion?) of people with the technology right at their fingertips.

Download the full report and learn more about what will drive (and block) adoption, and who has the advantage as we enter the next leg of the mobile wallet race.

Megan is CMB's Product Marketing Manager, she loves Alpine Replay, and longs for the day she can unlock the front door with her phone.